In the US, approximately 33% of households have a taxable investment account—often referred to as a brokerage account—and approximately 50% of households also have at least one retirement account, like an IRA or an employer-sponsored retirement account.

We know that the medley of account types can make it challenging for you to decide which account to contribute to or withdraw from at any given time.

Let’s dive right in to get a further understanding of:

What accounts are available and why you might choose them.The benefits of receiving dividends.Betterment’s powerful tax-sensitive features.

How Are Different Investment Accounts Taxed?

Taxable Accounts

Taxable investment accounts are typically the easiest to set up and have the least amount of restrictions.

Although you can easily contribute and withdraw at any time from the account, there are trade-offs. A taxable account is funded with after-tax dollars, and any capital gains you incur by selling assets, as well as any dividends you receive, are taxable on an annual basis.

While there is no deferral of income like in a retirement plan, there are special tax benefits only available in taxable accounts such as reduced rates on long-term gains, qualified dividends, and municipal bond income.

Key Considerations

You would like the option to withdraw at any time with no IRS penalties.You already contributed the maximum amount to all tax-advantaged retirement accounts.

Traditional Accounts

Traditional accounts include Traditional IRAs, Traditional 401(k)s, Traditional 403(b)s, Traditional 457 Governmental Plans, and Traditional Thrift Savings Plans (TSPs).

Traditional investment accounts for retirement are generally funded with pre-tax dollars. The investment income received is deferred until the time of distribution from the plan. Assuming all the contributions are funded with pre-tax dollars, the distributions are fully taxable as ordinary income. For investors under age 59.5, there may be an additional 10% early withdrawal penalty unless an exemption applies.

Key Considerations

You expect your tax rate to be lower in retirement than it is now.You recognize and accept the possibility of an early withdrawal penalty.

Roth Accounts

Includes Roth IRAs, Roth 401(k)s, Roth 403(b)s, Roth 457 Governmental Plans, and Roth Thrift Saving Plans (TSPs)

Roth type investment accounts for retirement are always funded with after-tax dollars. Qualified distributions are tax-free. For investors under age 59.5, there may be ordinary income taxes on earnings and an additional 10% early withdrawal penalty on the earnings unless an exemption applies.

Key Considerations

You expect your tax rate to be higher in retirement than it is right now.You expect your modified adjusted gross income (AGI) to be below $140k (or $208k filing jointly).You desire the option to withdraw contributions without being taxed.You recognize the possibility of a penalty on earnings withdrawn early.

Beyond account type decisions, we also use your dividends to keep your tax impact as small as possible.

Four Strategies Betterment Uses To Help You Limit Your Tax Impact

1. We use any additional cash to rebalance your portfolio.

When your account receives any cash—whether through a dividend or deposit—we automatically identify how to use the money to help you get back to your target weighting for each asset class.

Dividends are your portion of a company’s earnings. Not all companies pay dividends, but as a Betterment investor, you almost always receive some because your money is invested across thousands of companies in the world.

Your dividends are an essential ingredient in our tax-efficient rebalancing process. When you receive a dividend into your Betterment account, you are not only making money as an investor—your portfolio is also getting a quick micro-rebalance that helps keep your tax bill down at the end of the year.

And, when market movements cause your portfolio’s actual allocation to drift away from your target allocation, we automatically use any incoming dividends or deposits to buy more shares of the lagging part of your portfolio.

This helps to get the portfolio back to its target asset allocation without having to sell off shares. This is a sophisticated financial planning technique that traditionally has only been available to larger accounts, but our automation makes it possible to do it with any size account.

Beyond dividends, Betterment also has a number of features to help you optimize for taxes. Let’s demystify these three powerful strategies.

Performance of S&P 500 With Dividends Reinvested

Source: Bloomberg. Performance is provided for illustrative purposes to represent broad market returns for the U.S. Stock Market. The performance is not attributable to any actual Betterment portfolio nor does it reflect any specific Betterment performance. As such, it is not net of any management fees. The performance of specific U.S. Stock Market funds in the Betterment portfolio will differ from the performance of the broad market returns reflected here.

2. Tax loss harvesting.

Tax loss harvesting can lower your tax bill by “harvesting” investment losses for tax reporting purposes while keeping you fully invested.

When selling an investment that has increased in value, you will owe taxes on the gains, known as capital gains tax. Fortunately, the tax code considers your gains and losses across all your investments together when assessing capital gains tax, which means that any losses (even in other investments) will reduce your gains and your tax bill.

In fact, if losses outpace gains in a tax year you can eliminate your capital gains bill entirely. Any losses leftover can be used to reduce your taxable income by up to $3,000. Finally, any losses not used in the current tax year can be carried over indefinitely to reduce capital gains and taxable income in subsequent years.

How do I do it?

When an investment drops below its initial value—something that is very likely to happen to even the best investment at some point during your investment horizon—you sell that investment to realize a loss for tax purposes and buy a related investment to maintain your market exposure.

Ideally, you would buy back the same investment you just sold. After all, you still think it’s a good investment. However, IRS rules prevent you from recognizing the tax loss if you buy back the same investment within 30 days of the sale. So, in order to keep your overall investment exposure, you buy a related but different investment. Think of selling Coke stock and then buying Pepsi stock.

Overall, tax loss harvesting can help lower your tax bill by recognizing losses while keeping your overall market exposure. At Betterment, all you have to do is turn on Tax Loss Harvesting+ in your account.

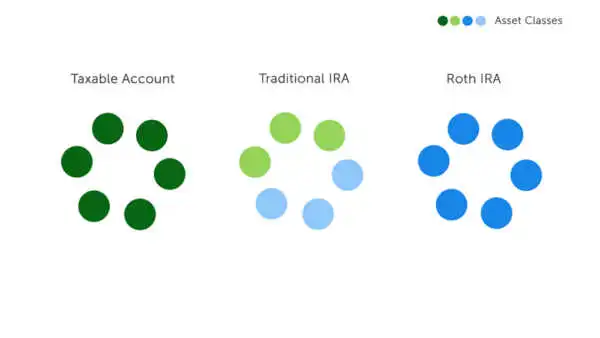

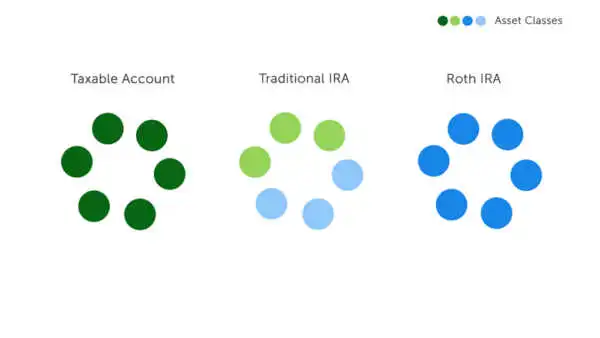

3. Asset location.

Asset location is a strategy where you put your most tax-inefficient investments (usually bonds) into a tax-efficient account (IRA or 401k) while maintaining your overall portfolio mix.

For example, an investor may be saving for retirement in both an IRA and taxable account and has an overall portfolio mix of 60% stocks and 40% bonds. Instead of holding a 60/40 mix in both accounts, an investor using an asset location strategy would put tax-inefficient bonds in the IRA and put more tax-efficient stocks in the taxable account.

In doing so, interest income from bonds—which is normally treated as ordinary income and subject to a higher tax rate—is shielded from taxes in the IRA. Meanwhile, qualified dividends from stocks in the taxable account are taxed at a lower rate, capital gains tax rates instead of ordinary income tax rates. The entire portfolio still maintains the 60/40 mix, but the underlying accounts have moved assets between each other to lower the portfolio’s tax burden.

Here’s what asset location looks like in action:

4. We use ETFs instead of mutual funds.

Have you ever paid capital gain taxes on a mutual fund that was down over the year? This frustrating situation happens when the fund sells investments inside the fund for a gain, even if the overall fund lost value. IRS rules mandate that the tax on these gains is passed through to the end investor, you.

While the same rule applies to exchange traded funds (ETFs), the ETF fund structure makes such tax bills much less likely. In fact, most of the largest stock ETFs have not passed through any capital gains in over 10 years. In most cases, you can find ETFs with investment strategies that are similar or identical to a mutual fund, often with lower fees.

We go the extra mile for your money.

Following these four strategies can help eliminate or reduce your tax bill, depending on your situation.

At Betterment, we’ve automated these and other tax strategies, which means tax loss harvesting and asset location are as easy as clicking a button to enable it. We do the work, and your wallet can stay a little fuller.

Learn more about how Betterment helps you maximize your after-tax returns.

Invest with us

Get Started>

Did you miss our previous article…

https://www.toroption.co/?p=181