We sat down with three influencers to pull back the curtain on some of the unique factors of LGBTQ+ financial planning, and what that planning, saving, and investing actually looks like.

CHRISTOPHER RHODES

What’s a financial goal that you’re currently working towards? Or, what’s a financial goal you’re proud of achieving?

Saving for top surgery was probably the largest financial goal I’ve achieved thus far in my life. Top surgery is a huge part of many trans masculine people’s lives, and that surgery was incredibly affirming for me and life changing. My insurance did not cover the procedure so I was left with the full amount to cover on my own, which can be quite daunting.

What tools and habits helped you reach that goal?

I am self-employed and so saving money can be difficult, but the company I run helps trans folks afford gender-affirming surgeries. By the time I was saving money for top surgery we had partnered with five individuals before me to help them reach their financial goals. My brand helped raise about half of the funds I needed for my surgery, and besides that I used my skills to help raise the funds—I did custom art, tattoo designs, and social media work for money. I also was just a lot more conscious about what I was putting away in savings at the time and for what.

Nowadays, my biggest goal is saving for the future: Hopefully saving to buy a house, and I do so by having a specific goal and timeline for the amount of savings I have in my account. By dedicating certain paychecks specifically to paying off debt or savings, versus for spending.

What would you tell your younger self about money?

Money is stressful, and a little bit complicated. I don’t think anyone when they’re younger quite comprehends how expensive being an adult is. But I think I’d tell myself that it’s possible to do what you love and still be able to afford a living— you just have to figure out how to make that work for you, and be responsible and smart about where and how and why you spend your money.

Has your identity influenced your relationship with money in any way? Why or why not?

I do think that in some aspects my relationship with money is definitely different than it would be if I wasn’t trans.

The costs of transitioning add up, between doctor’s visits, blood work, weekly testosterone injections, surgeries, the legal costs of changing my name and gender marker, not even to mention the costs of family planning one day, etc.

I had to account for saving up for things that felt very “adult” starting when I was in my young 20’s.

Start saving for your goals

Join Betterment>

ZOE STOLLER

What’s a financial goal you are currently working towards, or what’s one that you’ve already achieved and are really proud of?

I’m officially going to graduate school! I’ve left my 9 to 5 marketing job, and am working more fully as a content creator. I’m saving for graduate school and it’s a lot of work, but I’m confident that I’ll achieve my financial goal. I had known before I decided to enroll that my full time job wasn’t as fulfilling as I wanted it to be, and I recently started making enough money as a content creator to leave. So all the stars aligned, where I was able to leave my job, do content creation full time, and go back to school for my graduate degree.

What habits or tools are helping you reach that goal?

I’ve gotten very into spreadsheets lately—even though I’m not confident with numbers or money. It’s been a year of transition for me to figure out exactly how to keep meticulous track of my income, my big expenses, and my savings. I’ve been trying to be really proactive, financially.

What would you tell your younger self about money?

I was very clueless about money, but I have a lot more knowledge now.

Growing up, I didn’t understand saving, investing, or general money management. I’d tell my younger self that it’s okay not to know those things, but life is about learning and growing, and going on different journeys. Just because younger me wasn’t very financially aware, doesn’t mean that it’s always going to be that way.

And now, I feel much more knowledgeable about money—I’m still learning a lot, but I’m much more confident.

Has your identity influenced your relationship with money? Why or why not?

As I’ve discovered my lesbian and non-binary identities, I’ve definitely thought about how money will play a role in my future. There are so many more expenses that come with having a family or getting pregnant when you’re LGBTQ. I want a family, but I’ll probably have to do fertility treatments or maybe adoption. There are so many added obstacles that require money when you can’t conceive with a partner, so I’ve been thinking about how to best prepare for that in my future. I want to be able to afford that, should I decide it’s in my future.

nything else you’d like to share with us?

Wherever you are in your money and identity journeys, I have full confidence that you will make it through and achieve the goals you’ve set for yourself.

GENVIEVE JAFFE

What’s a financial goal that you’re currently working towards? Or, what’s a financial goal you’re proud of achieving?

My wife and I are hoping to build our dream home next year, in 2022. We want to buy in a community around my home, and we want to be able to put down a lot of money. When we bought our first house, we only put down 10% and had to get a PMI. We’d like to not do that this time, so that’s a big financial goal right now.

What tools and habits helped you reach that goal?

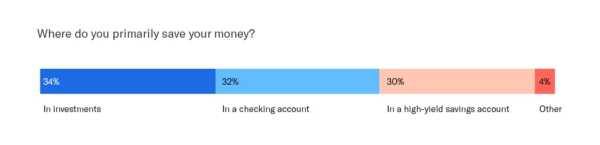

We have two different investment accounts that we use for the house fund. One is super safe – not risky at all, because we want to be safe if anything should happen. I also have a moderately aggressive portfolio that I don’t manage myself. When COVID hit, it did take a downturn, so it’s important for us to have half in a safer type of investment. In terms of allocating my money, any time I have money coming in from my business, I put some aside into these accounts. My wife and I also have a 529 plan that we put money in for our kids at the end of every year.

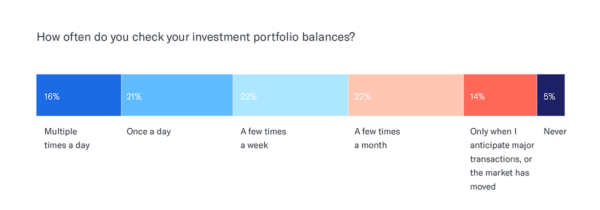

Additionally, my wife is very on top of our expenses and keeping track of our books. Almost every day she goes into all of our accounts to check balances, check for invoices, and double check our credit cards, student loans, etc.

What would you tell your younger self about money?

I grew up with working class parents. They traded money for hours, and that’s not a bad thing, but it’s not the way I wanted to live my life. So I actually got a job as a corporate lawyer and was miserable, but had a really great paycheck. I’d always learned that you work until you can retire and live off your 401K, and it wasn’t until I met my wife, who was an entrepreneur, that I realized that’s not how I had to live my life.

So I’ve done a lot of mindset work around money, and getting rid of that old school belief that money doesn’t grow on trees. I try to really have a good relationship with money and remember that money is also an exchange of energy.

I also just wanted to share that in 2015, I almost had to file for bankruptcy. I was not smart with my money at all. I’d been a corporate lawyer making a very nice, steady paycheck, and when I quit my job, the business that I started actually did very well. But it wasn’t this consistent substantial paycheck I was used to, and I hadn’t changed my habits or my lifestyle. SO I really had to learn quickly to be cognizant of the money that I have, and not rely on the money that I could potentially earn. I did not have to file bankruptcy, thank goodness. But, that fear is something that still lives within me—and now it’s really about being conscious of the money we have and the money we’re spending.

Has your identity influenced your relationship with money in any way? Why or why not?

We spent $50K+ having our children. I don’t say this to freak anyone out but to help prepare you for potential costs that you could incur growing your family as an LGTBQ+ individual / couple / throuple, etc.

We had no idea how much money we were about to drop when we started to grow our family. Our path to pregnancy wasn’t super straightforward—we ended up doing 3 intrauterine inseminations (IUI), two egg retrievals, and three embryo transfers. Insurance didn’t cover in vitro fertilization (IVF), stimulation meds (about $5K), egg retrieval ($11K), or transfer ($3K). We also had to buy sperm (they’re about $1,000 per vial), go through tons of testing, and we each had to have surgery.

Financially planning for a family is something that I stress people should start early. Seriously, ask for people to contribute to a baby fund for your engagement and wedding. Trust me, no one needs fancy dish-ware. Everyone loves babies and it’s an incredible way to make everyone feel part of your journey!

Begin your financial journey

Join Betterment>

If you’re interested in joining our team, check out the Betterment careers page! We’re always looking for passionate candidates to join our company.

Did you miss our previous article…

https://www.toroption.co/?p=226