If you’ve ever been told to “sit tight and stay the course” when the market is dropping and your investment account is worth less than it was just moments ago, you’re not alone. Financial advisors, including Betterment, love this mantra and repeat it anytime there’s a market downturn—which every investor should be prepared to navigate at some point.

But being told to do nothing when your account balance is dropping can feel like an inadequate response. And, unless your investment strategy has been designed from the ground up to anticipate and react to market volatility, you may be right.

The reason Betterment can confidently advise our customers not to react or adjust their investment strategy during a market downturn is because our entire platform was designed with inevitable downturns of the market in mind.

In this article, I’ll cover how our investment portfolio creation process, ongoing automated account management system, and dynamic advice, are designed with market fluctuations in mind, so that you can “sit tight and stay the course” and feel confident it’s actually the right thing to do.

Our portfolios are constructed with market volatility in mind.

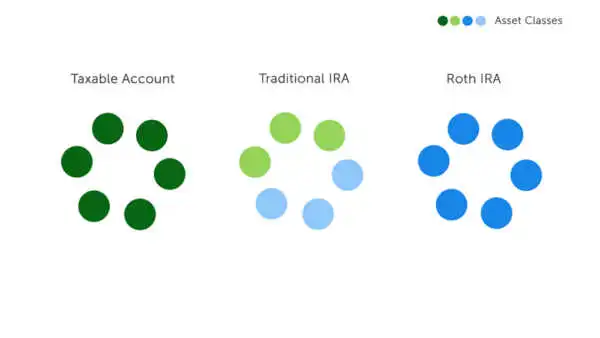

Betterment’s portfolio construction process strives to design a portfolio strategy that is diversified, increases value by managing costs, and enables good tax management. Ultimately, our goal is to help you build wealth.

This means: Our intent is to create portfolios designed to have the greatest chance of making money and also not losing it.

At a baseline, our allocation recommendations are based on various assumptions, including a range of possible outcomes, in which we give slightly more weight to potential negative ones, by building in a margin of safety—otherwise known as ‘downside risk’ or uncertainty optimization.

So, even before you’ve invested your first dollar, your portfolio has already been designed to account for the market fluctuations you will inevitably experience throughout the course of your investment journey, even the big downturns like 2008 and the more recent market crash in 2020.

Furthermore, our risk recommendations consider the amount of time you’ll be invested for. For goals with a longer time horizon, we advise that you hold a larger portion of your portfolio in stocks. A portfolio with greater holdings in stocks is more likely to experience losses in the short-term, but is also more likely to generate greater long-term gains. For shorter-term goals, we recommended a lower stock allocation. This helps to avoid large drops in your balance right before you plan to withdraw and use what you’ve saved.

All you have to do is:

Tell us what you are saving for (your investing goal).Let us know how long you plan to be invested (your time horizon).

We take care of the rest.

By using your personal assumptions, in conjunction with our general downside risk framework, we’re able to recommend a globally diversified portfolio of stock and bond ETFs that has an initial risk level recommended just for you.

And because we weigh investment time horizon and below-average market performance more heavily, our algorithm allows for some breathing room. If you wish to deviate from our advice— like increasing or decreasing your exposure to stocks or bonds, slightly beyond our default recommendation but still within a reasonable bound—we’ll still maintain the integrity of a properly diversified portfolio and investment strategy designed to meet your specific objective.

After all, the chance of reaching any investing goal increases when the investor is comfortable committing to their strategy and staying the course in both good and bad markets.

Our automated portfolio management features keep you on track during downturns.

How we construct our globally diversified portfolios and the risk framework we apply to each investor’s specific allocation recommendation is just the starting point. It’s our ongoing and automated portfolio management that provides the additional value-add that’s hard to replicate elsewhere, especially in times of heightened volatility.

Our automated features like allocation adjustments over time, portfolio rebalancing, tax loss harvesting for those who select it, and updated advice when you need it, are what help most.

utomated Allocation Adjustments

When we ask you to tell us about your investment objective, including how long you plan to be invested for, it helps us choose the appropriate asset allocation for you throughout the course of your investment timeline, not just in the beginning.

For most Betterment goals, we recommend that you scale down your risk as your goal’s end date gets closer, which helps to reduce the chance that your balance will drastically fall if the market drops. This is an especially important consideration for an investor who plans to use their funds in the near term.

We call this recommendation of a gradual reduction of stocks in favor of bonds, a goal’s glidepath. And instead of leaving this responsibility up to you, you can opt into our “auto-adjust” feature, which means our system monitors your account and adjusts your portfolio’s allocation automatically over time.

utomated Portfolio Rebalancing

The allocation that we choose for you, at any given time, is our best estimate of the combination of assets that will help you reach your goal by the date you’re aiming for. But, unless each asset you are invested in has the same exact returns, normal stock market fluctuations will likely cause your actual allocation to drift away from your portfolio target, which is calculated to be the optimal level of risk you should be taking on.

We call this process portfolio drift, and though a small amount of drift is perfectly normal—and a mathematical certainty—a large amount of drift could expose your portfolio to unwanted risks.

When the market fluctuates, not all of your investments are dropping to the same exact degree. For example, stocks are generally more volatile than bonds.

As you can imagine, a period of sustained volatility could mean a significant shift in how your portfolio is actually allocated, relative to where it should be. Left unchecked, this drift could be especially harmful to your portfolio’s performance, which is why at Betterment, our portfolio management system provides ongoing monitoring of your portfolio in order to determine whether rebalancing is needed.

While we generally use any cash inflows, like deposits or dividends, and outflows, like withdrawals, to help rebalance your portfolio organically over time, when a significant market drop occurs, there can be a need to sell investments in order to adjust your portfolio back to its optimal allocation.

Consider an instance where the value of your stock investments has dropped significantly and now your bond investments are overweighted relative to your stocks. Our rebalancing system might be triggered to correct the drift. Not only would our automated rebalancing seek to ensure your portfolio’s allocation is realigned relative to its target, it would also mean buying stocks at their currently cheaper price point, setting you up nicely for any market recovery.

Furthermore, if effective rebalancing does require selling investments in a taxable account, the specific shares to be sold are selected tax-efficiently using our TaxMin method. This is designed to ensure that no short-term gains are realized. We never want the tax impact of maintaining proper diversification to counter the benefits of applying our risk framework.

utomated Tax Loss Harvesting

Tax Loss Harvesting is a feature that may benefit you most when the market is volatile. After all, if there aren’t any losses in your account, we can’t harvest them. Our automated TLH software monitors your account for opportunities to effectively harvest tax losses that can be used to reduce capital gains that you have realized through other investments in the same tax year.

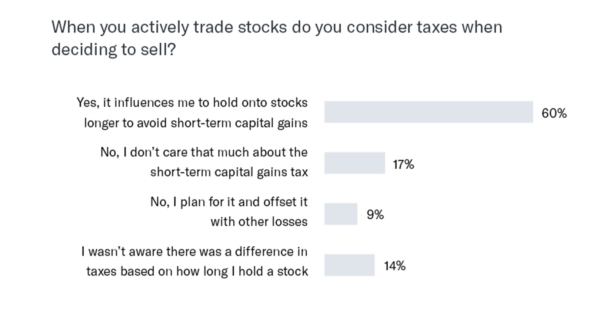

This can potentially reduce your tax bill, thereby increasing your total returns, especially if you have a lot of short-term capital gains, which are taxed at a higher rate than long-term capital gains.

And, if you’ve harvested more losses than you have in realized capital gains, you can use up to an additional $3,000 in losses to reduce your taxable income. Any unused losses from the current tax year can be carried over indefinitely and used in subsequent years.

Our dynamic financial advice works for you during market fluctuations.

Much like the automated features described in the section above, the advice we give our customers is dynamic and updates automatically based on many factors, including market performance.

Just as your car’s GPS recommends the best route to take to reach your destination, Betterment recommends a tailored path toward reaching your financial goals. And just as the GPS updates its recommended route based on road conditions and accidents, we update our advice based on various circumstances, such as a market downturn.

In addition to recommending a starting risk level tied to your specific objective, we also estimate how much you need to save.

In the case of a really big market drop, we might advise you to do something about it, such as make a single lump-sum deposit, which will help keep your portfolio on track. Recognizing that coming up with sizable excess cash can be tough to do, we’ll also suggest a recurring monthly deposit number that may be more realistic. And, if it’s early on in a long-term goal, it’s unlikely you’ll need to change anything significantly, because you still have a lot of time on your side.

Conclusion

The path to investment growth can be bumpy, and negative or lower than expected returns are bound to make an investor feel uncertain. But, staying disciplined and sticking to your plan can pay off.

Betterment has been purpose-built with all the worst and the best the market may throw at us in mind, by focusing on three key elements: intentional portfolio construction, automated portfolio features, and advice that reacts to market conditions.

Feel confident that Betterment’s hard at work, for you, so that you can truly “sit tight and stay the course.”

Let’s ride this out together

Sign up>

Did you miss our previous article…

https://www.toroption.co/?p=291